Cost-Effective

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

Trust us as your direct lender with a modern approach! Your data stays safe, and we support you in tough times

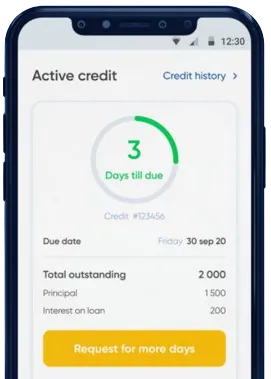

Seamless solutions in just 10 minutes from home. Instant money transfer and options to extend your loan

Enter your application details in the app by filling out the form.

Await approval. Decisions are typically made within 15 minutes.

Get the funds. Transactions are generally completed in one minute.

Enter your application details in the app by filling out the form.

Download loan app

Online payday loans have become a popular financial option in South Africa for individuals who need quick access to cash. These short-term loans can be a lifesaver in times of unexpected emergencies or when facing sudden expenses.

One of the main benefits of online payday loans is the convenience and accessibility they offer. With a few clicks on your computer or mobile device, you can apply for a loan from the comfort of your home or office. This eliminates the need to visit a physical lender or bank, saving you time and effort.

Moreover, online payday loan providers in South Africa operate 24/7, allowing you to apply for a loan at any time of the day or night. This flexibility is crucial when facing urgent financial situations that cannot wait.

In addition, the application process for online payday loans is typically straightforward and can be completed within minutes. You only need to provide basic personal and financial information, and the approval decision is often made quickly.

Another advantage of online payday loans is the speed at which you can get approved and receive the funds. In many cases, you can expect to get the money in your bank account within 24 hours of approval.

This quick turnaround time can be crucial when facing time-sensitive financial needs, such as medical emergencies or car repairs. Online payday loans provide a reliable solution for getting the cash you need without lengthy delays.

Online payday loan providers in South Africa offer flexibility in loan amounts, allowing you to borrow only what you need. Whether you require a small loan to cover a minor expense or a larger sum for a critical situation, you can find options that meet your financial needs.

When applying for an online payday loan in South Africa, you can expect transparent terms and fees that are clearly outlined before you accept the loan offer. This transparency helps you understand the total cost of borrowing and make informed decisions about your financial obligations.

Additionally, reputable online payday loan providers adhere to responsible lending practices and comply with regulatory requirements to protect consumers from unfair terms and practices.

Online payday loans in South Africa provide a convenient and accessible financial solution for individuals facing unexpected expenses or emergencies. With their fast approval process, flexibility in loan amounts, and transparent terms, online payday loans can be a valuable resource for managing short-term financial needs.

Online payday loans are short-term, unsecured loans that are processed digitally and intended to help borrowers cover immediate financial needs until their next payday. These loans are usually small amounts and have to be repaid within a short period, typically two to four weeks.

To qualify for an online payday loan in South Africa, you generally need to be at least 18 years old, have a valid South African ID, a steady source of income, and an active bank account. Lenders may also require proof of residence, such as a utility bill, and a recent pay slip to verify your earnings.

The interest rate for online payday loans in South Africa can vary greatly, often ranging from 5% to 20% of the loan amount. Due to the high risk associated with these loans, the interest rates are typically higher than those of traditional bank loans. Always read the terms carefully before accepting an offer.

Yes, besides the interest rate, payday loans often include additional fees such as initiation fees, service fees, and penalty fees for late repayment. It’s crucial to review all associated costs in the loan agreement before proceeding.

The process for an online payday loan is usually quick, and you can often expect to receive funds within 24 to 48 hours after your application has been approved. Some lenders offer same-day disbursement, depending on their processing capabilities and cut-off times.

Before taking out an online payday loan, consider whether you can realistically repay the loan on time, evaluate if the interest rate and fees are financially manageable, and explore alternative funding options that might be available with more favorable terms.

If you fail to repay a payday loan on time, you may incur additional fees and interest charges, and it could negatively impact your credit score. The lender may take legal action to recover the debt, so it is always advisable to contact them immediately to renegotiate terms if you foresee a problem with repayment.

Yes, online payday loans in South Africa are regulated under the National Credit Act (NCA), which sets out consumer rights and lender obligations. It is essential to borrow from a lender registered with the National Credit Regulator (NCR) to ensure that the loan terms comply with legal requirements.